Wage Calculator with Tax Calculations

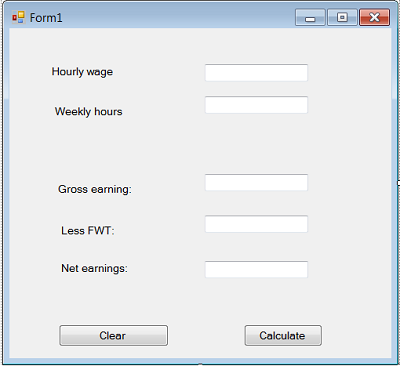

Develop an application that calculates an employee's earnings, as shown below.

The user should provide the hourly wage and number of hours worked per week. When the Calculate Button is clicked, the employee's gross earnings should display in the Gross earnings: TextBox. The Less FWT: TextBox should display the amount deducted for federal taxes and the Net earnings: TextBox should display the difference between the gross earnings and the federal tax amount. You can use the format specifier C with String method Format, to format the result as currency. Assume that overtime is calculated for hours over 40 hours worked, overtime wages are 1.5 times the hourly wage and federal taxes are 15% of gross earnings. The Clear Button should clear all fields. Set the TextAlign properties of the Labels that show the results to MiddleRight so that the values are aligned at their decimal points.

Form1 = Wage Calculations This is the title

Hourly wage = wageLabel wageTextBox

Weekly hours= hoursLabel hoursTextBox

Gross earnings = earningsLabel earningsResultLabel

Less FWT = fwtLabel fwtResultLabel

Net earnings = netEarningsLabel netResultLabel

Clear = clearButton calculateButton