Question

Learning for Numeric Prediction

(a) Let the weights of a two-input perceptron be: w0 = 0:2, w1 = 0:5 and w2 = 0:5. Assuming that x0 = 1, what is the output of the perceptron when:

[i] x1 = 1 and x2 = 1 ?

[ii] x1 = 1 and x2 = 1 ?

Letting w0 = 0:2 and keeping x0 = 1, w1 = 0:5 and w2 = 0:5, what is the perceptron output when:

[iii] x1 = 1 and x2 = 1 ?

[iv] x1 = 1 and x2 = 1 ?

(b) Here is a regression tree with leaf nodes denoted A, B and C:

X <= 5 : A

X > 5 :

| X <= 9: B

| X > 9: C

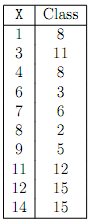

This is the training set from which the regression tree was learned:

Write down the output (class) values and number of instances that appear in each of the leaf nodes A, B and C of the tree.