The following article is reprinted in its entirety by permission from Forbes (April 1, 1991). Discuss the statistical method alluded to in this article. Could you reproduce (or improve upon) Professor Platt's results? Explain. Is a former $40 stock now trading at $2.50 a bargain? Or an invitation to get wiped out? Depends.

How Cheap?

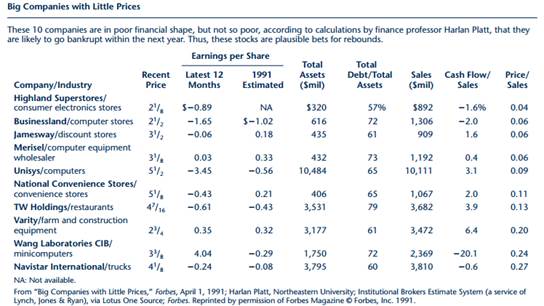

Harlan Platt, an associate professor of finance at Northeastern University, has written Why Companies Fail, a study that should be of considerable interest to bargain-hunting investors. Platt's study can be useful in helping determine whether a stock that has fallen sharply in price is a bargain or a prospective piece of wallpaper. Platt developed a mathematical model that predicts the probability of bankruptcy from certain ratios on a company's balance sheet. Here's the thesis: Some companies trading very cheaply still have large sales, considerable brand recognition and a chance at recovery, or at least takeover at a premium. Their stocks could double or triple despite losses and weak balance sheets. Other borderline companies will land in bankruptcy court and leave common shareholders with nothing. Even though it more than tripled from its October low, Unisys, with $10 billion in sales, is not a Wall Street favorite: At a recent 51 ⁄2 its market capitalization is only $890 million. Will Unisys fail? Almost certainly not within the next 12 months, according to Platt. For the list below, we found cheap stocks with low price-to-sales ratios. Then we eliminated all but the ones Platt says are highly unlikely to fail within a year. Platt put cheap stocks such as Gaylord Container, Masco Industries and Kinder-Care Learning Centers in the danger zone. Among low-priced stocks, Unisys and Navistar, however, make the safety grade. So does Wang Laboratories. Says Platt, "They are still selling over $2 billion worth of computers and their $575 million in bank debt is now down to almost nothing." Platt, who furnishes his probabilities to Prospect Street Investment Management Co., a Boston fund manager, refuses to disclose his proprietary formula. But among the ratios he considers are total debt to total assets, cash flow to sales, short-term debt to total debt, and fixed assets to total assets. "Companies with large fixed assets are more likely to have trouble because these assets are less liquid," Platt says. But norms for a company's industry are also important. An unusually high level of such current assets as inventory and receivables may itself be a sign of weakness. The low-priced stocks on the list may or may not rise sharply in the near future, but they are not likely to disappear into insolvency.

-STEVE KICHEN