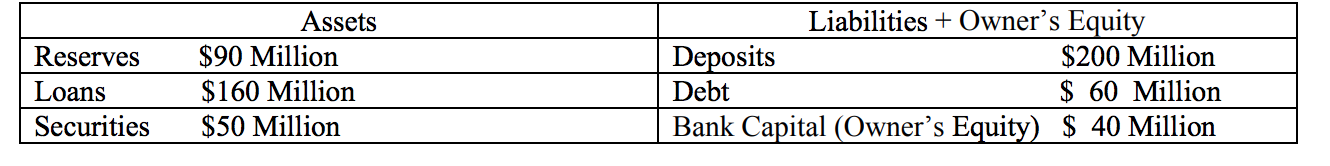

Suppose the following bank balance sheet represents all banks in a small country.

a) What is the money-multiplier in this small island economy?

b) If the country's central bank buys $10 million in bonds from this bank, what will be the money supply (M1)?

c) If you were told that these banks are actually holding $60 million in excess reserves, what must be the reserve requirement?

d) Suppose the government decides that banks must maintain a leverage ratio of 5 to 1 or better. Using the original balance sheet provided, what, if anything, would these banks need to do?