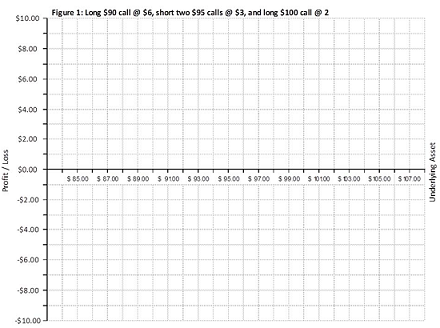

Q1. Draw the return (including underlying options for a strategy that involves Longing $90 call @ $6.00, shorting two $95 calls @ $3.00, and longing one $100 call @ $2.00. Answer the questions below the graph.

(a) Does the strategy have a name? If so what is it?

(b) What is the most that the strategy holder can make with this strategy?

(c) What is the most that the strategy holder can lose with this strategy?

(d) Describe the strategy. That is, what must a buyer or sell think about the market in order to enter into the strategy?

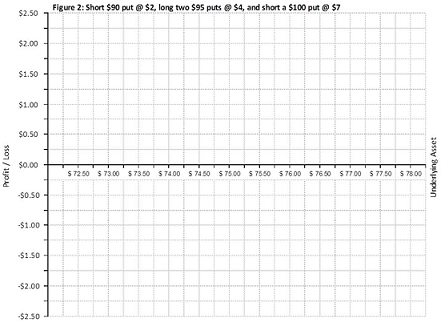

Q2. Draw the return (including underlying options for a strategy that involves: shorting a $90 put @ $2.00, longing two $95 puts @ $4.00 and shorting a $100 put @ $7.00. Answer the questions below the graph.

(a) Does the strategy have a name? If so what is it?

(b) What is the most that the strategy holder can make with this strategy?

(c) What is the most that the strategy holder can lose with this strategy?

(d) Describe the strategy. That is, what must a buyer or sell think about the market in order to enter into the strategy?

Q3. Draw the return (including underlying options or stocks) for a strategy that involves: owning a stock purchased at a price of $22.00 and buying a $20 put option @ $0.50. Answer the questions below the graph.

(a) Does the strategy have a name? If so what is it?

(b) What is the most that the strategy holder can make with this strategy?

(c) What is the most that the strategy holder can lose with this strategy?

(d) Describe the strategy. That is, what must a buyer or sell think about the market in order to enter into the strategy?

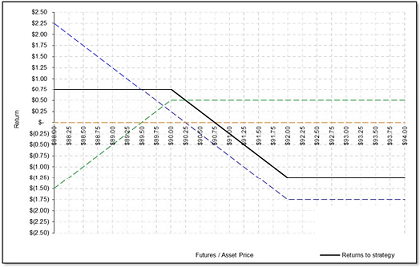

Q4. Examine the option strategy shown below (the solid line represents the strategy and the dotted lines represent the underlying options used to create the strategy). Answer the questions below the graph.

(a) Describe the underlying components to this strategy, e.g., sell or buy call or put with strike prices and premiums.

(b) Does the strategy have a name? If so what is it?

(c) What is the most that the strategy holder can make with this strategy?

(d) What is the most that the strategy holder can lose with this strategy?

(e) Describe the strategy. That is, what must a buyer or sell think about the market in order to enter into the strategy?

Q5. A trader would like to add 100 shares of XYZ stock into their portfolio within the next three months using bank funds that are currently earning an annual return of 5%. XYZ has had an annual return of 7% and the trader expects this return to continue into the future. The trader is examining the potential of obtaining XYZ stock via the strategy we have referred to as "improving on the market." XYZ stock is trading in the stock market at a price of $15.95. Three-month out options on the XYZ stock are listed as follows:

|

Call Options

|

Put Options

|

|

Strike Price

|

Premium

|

Strike Price

|

Premium

|

|

$ 17.00

|

$ 0.22

|

$ 17.00

|

$ 1.09

|

|

$ 16.00

|

$ 0.45

|

$ 16.00

|

$ 0.49

|

|

$ 15.00

|

$ 1.10

|

$ 15.00

|

$ 0.15

|

|

$ 14.00

|

$ 2.00

|

$ 14.00

|

$ 0.02

|

(a) Which call options are "in-the-money?"

(b) Which put options are "in-the-money?"

(c) Describe how the trader could implement an "improving on the market" strategy. Be sure to explain what position the trader should take, what type of option should be used, and which strike price should be selected (explain how to determine the strike price).

(d) Assume that trader implements the strategy as outlined in part (c) using the option that is deepest-in-the-money and that the option is not exercised until expiration. How much will the trader save by implementing the strategy relative to purchasing the stock today?

(e) Show where the savings obtained via the strategy was obtained.

(f) Given the trader's cost of capital would you recommend that they implement the strategy? Explain.

Attachment:- Assignment Notes.rar