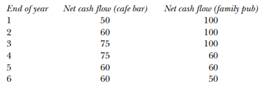

A pub management company acquired a derelict public house when they took over a rival business. They want to renovate it as either a cafe bar offering a wide range of drinks or a family pub concentrating on food. The cost of fitting it out as a cafe bar is £200,000, the cost of making it into a family pub is £300,000. The income anticipated from each of these options (in £000s) is:

The company believes in theme pubs and refits all its sites after six years. They do not expect any of the fixtures and fittings to have a disposal value.

(a) Identify the payback period for each option.

(b) Calculate the net present value of each options using a discount rate of 12%.