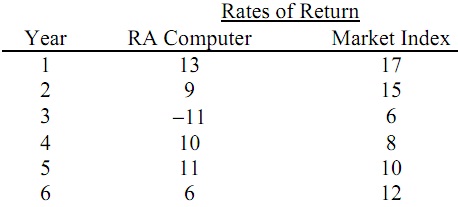

USE THE GIVEN INFORMATION FOR THE NEXT PROBLEM(S):

problem 1: Refer to information above. find out the beta for RA Computer by using the historic returns presented above.

a) 0.7715

b) 1.2195

c) 1.3893

d) 1.1023

e) - 0.7715

problem 2: Refer to information above. find out the correlation coefficient between RA Computer and the Market Index.

a) -0.32

b) 0.78

c) 0.66

d) 0.58

e) 0.32

problem 3: Refer to information above. find out the intercept of the characteristic line for RA Computer.

a) -9.41

b) 11.63

c) 4.92

d) -7.98

e) -4.92

problem 4: Refer to information above. If you expected return on the Market Index to be 12%, what would you expect the return on RA Computer to be?

a) 7.26%

b) 6.75%

c) 8.00%

d) 9.37%

e) -3.29%

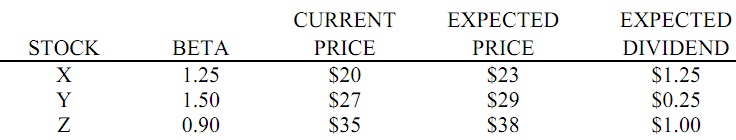

USE THE GIVEN INFORMATION FOR THE NEXT PROBLEM(S):

You expect the risk-free rate (RFR) to be 3% and the market return to be 8%. You as well have the given information about three stocks.

problem 5: Refer to information above. What are the expected (required) rates of return for the three stocks (in the order X, Y, Z)?

a) 16.50%, 5.50%, 22.00%

b) 9.25%, 10.5%, 7.5%

c) 21.25%, 8.33%, 11.43%

d) 6.20%, 2.20%, 8.20%

e) 15.00%, 3.50%, 7.30%

problem 6: Refer to information above. What are the estimated rates of return for the three stocks (in the order X, Y, Z)?

a) 21.25%, 8.33%, 11.43%

b) 6.20%, 2.20%, 8.20%

c) 16.50%, 5.50%, 22.00%

d) 9.25%, 10.5%, 7.5%

e) 15.00%, 3.50%, 7.30%

problem 7: Refer to information above. What is your investment strategy regarding the three stocks?

a) Buy X and Y, sell Z.

b) Sell X, Y and Z.

c) Sell X and Z, buy Y.

d) Buy X, Y and Z.

e) Buy X and Z, sell Y.

problem 8: The expected return for Zbrite stock computed by using the CAPM is 15.5%. The risk free rate is 3.5% and the beta of the stock is 1.2. Computed the implied market risk premium.

a) 5.5%

b) 6.5%

c) 10.0%

d) 15.5%

e) 12.0%

problem 9: Consider the given two factor APT model:

E(R) = λ0 + λ1b1 + λ2b2

a) λ1 is the expected return on the asset with zero systematic risk.

b) λ1 is the expected return on asset 1.

c) λ1 is the pricing relationship between the risk premium and the asset.

d) λ1 is the risk premium.

e) λ1 is the factor loading.

problem 10: In the APT model the idea of riskless arbitrage is to assemble a portfolio that:

a) Needs some initial wealth, will bear no risk and still earn a profit.

b) Needs no initial wealth, will bear no risk and still earn a profit.

c) Needs no initial wealth, will bear no systematic risk and still earn a profit.

d) Needs no initial wealth, will bear no unsystematic risk and still earn a profit.

e) Needs some initial wealth, will bear no systematic risk and still earn a profit.