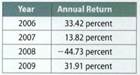

Question: Suppose at the beginning of 2006 you decide to invest $1,000 in Vanguard's European Stock Index mutual fund. The following table shows the returns for the years 2006-2009.

a. Calculate and interpret the arithmetic mean return.

b. Calculate and interpret the geometric mean return.

c. How much money would you have accumulated by the end of 2009?