Objective: This task will give you some experience using common time value of money related finance methods.

Specific Requirements for this Assignment:

1) You should use Microsoft Excel software for this assignment.

2) Submit a Microsoft Excel workbook titled SEB324 A3 Part 4.xlsx (or .xls)

3) Provide the computations and answers for all problems with one sheet in the workbook used for each problem. So that means your single submitted workbook file should consist of two spreadsheets. Label each spreadsheet in your workbook file respectively as problem 1 and problem 2.

4) Provide all answers to two decimal places and/or the nearest cent.

problem 1: You receive an offer in the mail from the Norman Harvey Bank inviting you to apply for a new personal loan. The offer invites you to access immediately up to $20,000 on this special personal loan with the principal amount to be repaid in full plus all accumulated interest in 24 months’ time. (There are no interim repayments to be made between now and when the total amount is due in 24 months’ time.) Interest will be computed on a monthly compounding basis at 0.72% per month.

Also in the mail you have received an offer from the West Bank inviting you to apply for a new term deposit account which pays a nominal interest rate of 8.65% p.a. computed monthly on a compounding basis. The minimum initial deposited amount required is $20,000 and any deposits must be left in the account for a minimum of 24 months.

You are considering applying for the personal loan from the Norman Harvey Bank in order to immediately invest the entire $20,000 into the West Bank term deposit account being offered. Does this investment opportunity offer a worthwhile positive return on investment from combining these two offers? Would you recommend this opportunity? Justify your answer.

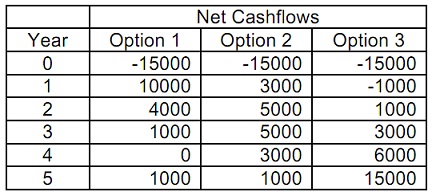

problem 2: You have been asked to evaluate the financial viability of three investment options for your company. You are asked to use the Simple Payback, IRR, and NPV methods to evaluate the options and make a recommendation on which of them, if any, to proceed with. The selection of any option is mutually exclusive. Perform simple payback, IRR, and NPV analyses on the investment options.

The expected nominal cashflows for Years 1 through 5 produced by each investment option are provided in the table below. The initial amount required for all three-investment options is $15,000. For the NPV analysis assume a cost of capital of 10% p.a. For the IRR analyses assume the minimum rate of return required for any option to be considered viable is 15% p.a.

Which investment option, if any, would you recommend and why? Justify your answer.