French Feline Foods (FFF)

Background:

French Feline Foods is a chief pet food manufacturer based in the south-western France. Thanks chiefly to its gourmet range of cat foods; it has enjoyed phenomenal growth in the recent years and is now the major up-market cat food supplier in the Europe. Its leading products comprise Fish Pie and Beef with Vegetables.

This position of market supremacy has led the owners to believe that extra expansion can only come through diversification and an opportunity has arisen to obtain Danish Dogs Dinners (DDD). Your marketing director is significantly keen as he thinks that some of DDD products (e.g. Pickled Herring) may go down well with FFFs customers.

But, your Chief Executive Officer is concerned that, the Danish company has problems with particular regard to the distribution. He has asked you to ‘look at situation’, and note down a report.

You’re Mission

Observe the distribution network of both companies (Appendix) and determine:-

i) In the short words, say 1 – 2 years, how you would restructure the combined distribution networks of two companies and estimation any savings that may result. In this timescale it will not be probable to acquire and open new facilities and the options are limited to restructuring use of the existing facilities

ii) In the longer term, recommend other improvements which could be made providing logical reasons for your ideas.

Your report (maximum 12 pages excluding appendices) must hold:

a) An analysis of the present situation

b) Reasons for your proposed (short term and longer term) solutions.

c) An estimate of savings which you expect to attain. Absolute accuracy in estimating costs is not required but you should justify any savings quoted with a summary of the method employed and computation.

d) A diagram showing the proposed distribution network

Appendix

Demand Data:

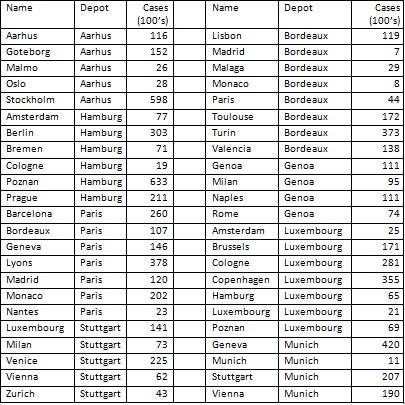

The following tables demonstrate the average monthly shipments (in 100s of cases) to each of the chief areas containing customers of the two companies

Danish Dogs Dinners:

Total monthly demand is 401600 cases split among the main customer areas as shown below

French Feline Foods:

Total monthly demand is 309600 cases split among the main customer areas as shown below