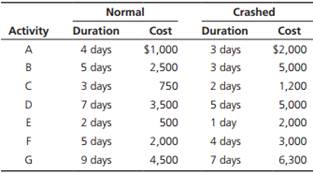

Question: You are considering the decision of whether or not to crash your project. After asking your operations manager to conduct an analysis, you have determined the "precrash" and "postcrash" activity durations and costs, shown in the following table (assume all activities are on the critical path):

a. Calculate the per day costs for crashing each activity.

b. Which are the most attractive candidates for crashing? Why?