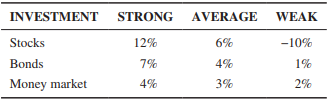

Question: Debbie Gibson is considering three investment options for a small inheritance that she has just received-stocks, bonds, and money market. The return on her investment will depend on the performance of the economy, which can be strong, average, or weak. The returns for each possible combination are shown in the following table:

Assume that Debbie will choose only one of the investment options.

(a) Which investment should Debbie choose if she uses the maximax criterion?

(b) Which investment should Debbie choose if she uses the maximin criterion?

(c) Which investment should Debbie choose if she uses the equally likely criterion?

(d) Which investment should Debbie choose if she uses the criterion of realism with a = 0.5?

(e) Which investment should Debbie choose if she uses the minimax regret criterion?