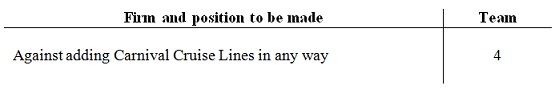

Case preparation

You have been hired by Disney’s board of directors to assess the potential addition to Disney’s corporate portfolio of three firms (Six Flags, Carnival Cruise, and QVC of Liberty Media). Use your understanding of Disney’s corporate strategy gained from the “Entertainment King” case as well information in the posted materials to take a position (see above) or to evaluate the potential addition based on the following:

problem1) What advantages would there be for Disney to add the firm to their portfolio? Disadvantages?

problem2) Would the addition of the firm be considered related or unrelated for Disney?

problem3) How would synergy be created? Be specific, use the logic and terminology of corporate strategy. If related, discuss sharing and transferring capabilities, scope economies, vertical integration, etc. and the specific resources and capabilities of both firms involved. If unrelated, discuss portfolio management, restructuring, etc. and how value would be created.

problem4) Prepare in advance and upload a slide(s) addressing the following:

a) Should Disney seek to add the company to their corporate portfolio? Make a clear (i.e., yes or no) recommendation based on your assigned position. Justify your rationale (based on 1-3 above).

b) If you’ve been assigned the “for” position, rank the three best mechanisms (acquisition, merger, joint venture, alliance, etc.) for adding this firm to the portfolio. Justify. If you’ve been assigned the “against” position, rank the three worst mechanisms for adding this firm to the portfolio. Justify.

c) How much will it cost to add the firm under these options?

d) Regardless of your “for” or “against” position, what advice would you provide to ensure a successful addition? How would you implement this?