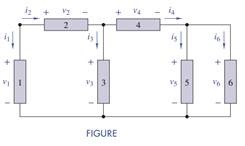

Figure shows an electric circuit with a voltage and a current variable assigned to each of the six devices.

Use power balance to find v4 when v1 = 20 V, i1 = -2 A, p2 = 20 W, p3 = 10 W, i4 = 1 A, and p5 = p6 = 2:5 W. Is device 4 absorbing or delivering power?