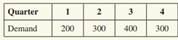

Question: The Johnson Company manufactures expensive medical diagnostic equipment. It plans to meet all of its projected demand (given below for the next year by quarter). The firm plans to use a constant production rate of 300 units/quarter. Production costs are $20,000 per unit and holding costs are $2,000 per quarter per unit.

What is the cost of this production plan?