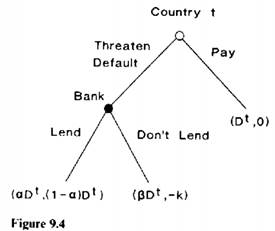

Question: Consider the following model of international debt repayment: A bank (representing the coalition of creditors) faces two countries sequentially. At date t e [1, 4, country t decides whether to pay its debt, or to threaten default. If it threatens default, the bank can either lend (or reschedule the debt) or not lend; the latter results in default. The stage game is illustrated in figure 9.4, where the first payoff is the bank's and the second is the country. (See Armendariz de Aghion 1990 for more motivation) Assume 1 > x > 0, x > β, and k > 0. The bank can be "soft" (have payoffs as in figure 9.4) or "tough" (never lend, because of pessimism about future repayment, or because of costly acquisition of cash reserves). Only the bank knows whether it is soft or tough. Assume that the bank's discount factor is equal to 1, and that (1 - p)(1 - a)Dt - pk > 0 for t = 1,2. where p is the prior probability that the bank is tough.

Solve for the equilibrium of this two-period game. If the bank had the choice between facing the low-debt country or the high-debt country first, which one would it choose? (Compare your answer to that of exercise)

Exercise: Consider the chain-store game as described in subsection 9.2.1. Suppose that there is a single potential entrant, two markets (A and 131, and two periods. The entrant can enter each market at most once and can enter at most one market per period, but he can choose which market to enter first. The incumbent is either tough in both markets or weak in both; the entrant is weak with probability 1. The tough incumbent always fights. Payoffs for the weak players in market A are as in subsection 9.2.1: The incumbent gets a if no entry, 0 if accommodate. - 1 if fight; the entrant gets h if accommodate, 0 if no entry, - 1 if fight. In market B, which is "big." all these payoffs are multiplied by 2. Which market should the entrant enter first? (Hint: Why might entering both markets at once, if feasible, be better than sequential entry?)