Problem

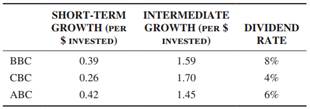

An investor is considering three different television news stocks to complement his portfolio: British Broadcasting Company (BBC), Canadian Broadcasting Company (CBC), and Australian Broadcasting Company (ABC). His broker has given him the following information:

The investor's criteria are as follows: (1) The investment should yield short-term growth of at least $1,000; (2) the investment should yield intermediate-term growth of at least $6,000; and (3) the dividends should be at least $250 per year. Determine the least amount the investor can invest and how that investment should be allocated between the three stocks.