Deepwater in Deep Trouble

When all is said and done, it’s likely to be one of the worst environmental disasters, if not the worst, in U.S. history.79 British Petroleum’s (BP) Deepwater Horizon offshore rig in the Gulf of Mexico exploded in a ball of flames on April 20, 2010, killing 11 employees. This initial tragedy set in motion frantic efforts to stop the flow of oil, followed by a long and arduous cleanup process. Although the impacts of the explosion and oil spill were felt most intensely by businesses and residents along the coast and by coastal wildlife, those of us inland who watched the disaster unfold were also stunned and dismayed by what we saw happening. What led to this disaster, and what should BP do to minimize the likelihood of it ever happening again?

One thing that has come to light in the disaster investigation is that it’s no surprise that something like this happened. After Hurricane Dennis blew through in July 2005, a passing ship was shocked to see BP’s new massive $1 billion Thunder Horse oil platform “listing precariously to one side, looking for all the world as if it were about to sink.” Thunder Horse “was meant to be the company’s crowning glory, the embodiment of its bold gamble to outpace its competitors in finding and exploiting the vast reserves of oil beneath the waters of the gulf.” But the problems with this rig soon became evident. A valve installed backwards caused it to flood during the hurricane even before any oil had been pumped. Other problems included a welding job so shoddy that it left underwater pipelines brittle and full of cracks. “The problems at Thunder Horse were not an anomaly, but a warning that BP was taking too many risks and cutting corners in pursuit of growth and profits.”

Then came the tragic explosion on the Deepwater Horizon. Before the rig exploded, there were strong warning signs that something was terribly wrong with the oil well. Among the red flags were several equipment readings suggesting that gas was bubbling into the well, a potential sign of an impending blowout. Those red flags were ignored. Other decisions made in the 24 hours before the explosion included a critical decision to replace heavy mud in the pipe rising from the seabed with seawater, again possibly increasing the risk of an explosion. Internal BP documents also show evidence of serious problems and safety concerns with Deepwater. Those problems involved the well casing and blowout preventer. One BP senior drilling engineer warned, “This would certainly be a worst-case scenario.”

he federal panel charged with investigating the spill examined 20 “anomalies in the well’s behavior and the crew’s response.” The panel is also investigating in particular why “rig workers missed telltale signs that the well was close to an uncontrolled blowout.” The panel’s final report blamed both BP and its contractors for the failures that led to the explosion on the Deepwater Horizon. Many of those failings stemmed from shortcuts to save time and money. However, the report also faulted the government for lax oversight of the companies.

Discussion Questions

1. What type(s) of control—feedforward, concurrent, or feedback—do you think would have been most useful in this situation? Explain your choice(s).

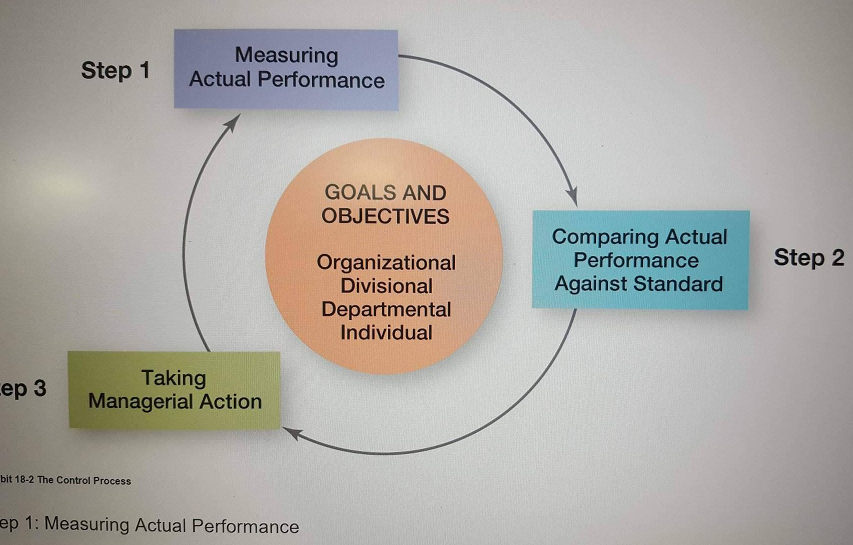

2. Using Exhibit 18–2, explain what BP could have done better.

3. Why do you think company employees ignored the red flags? How could such behavior be changed in the future?

4. What could other organizations learn from BP’s mistakes?

The control process is a three-step process of measuring actual performance, comparing actual performance against a standard, and taking managerial action to correct deviations or to address inadequate standards. The control process assumes that performance standards already exist, and they do. They’re the specific goals created during the planning process.?

exhibit 18-2 the control process