Q1. Describe the condition where an LPP can be categorized as an integer programming problem.

Q2. A retailer consists of the following month wise demand, price in euro and the inventory cost in euro/unit/month for generators:

Jan: demand = 3: Price in euro = 150 and inventory cost in euro/unit/month = 12

Feb: demand=4: Price in euro = 160 and inventory cost in euro/unit/month = 10

Mar: demand = 2: Price in euro = 175 and inventory cost in euro/unit/month = 10

By using the backward computational procedure for this Dynamic Programming problem, compute the optimal decision for each possible value of the state variable.

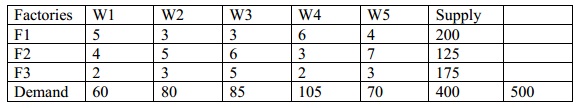

Q3. A company consists of three plants supplying the similar product to the five distribution centers. Due to the peculiarities inherent in the set of cost of manufacturing, the cost/unit will differ from plant to plant. This is illustrated below. There are restrictions in the monthly capacity of each plant, each distribution center consists of a specific sales requirement, capacity requirement and the cost of transportation is illustrated below:

The cost of manufacturing a product at different plants is Fixed cost is Rs. 7 x 105, 4 x 105 and 5 × 105 while the variable cost per unit is Rs.13/-, 15/- and 14/- correspondingly. Find out the quantity to be dispatched from each plant to different distribution centers, fulfilling the needs at minimum cost.