Your financial analysis report will be driven through a rigorous ratio analysis, and aggressively supplemented with your written analysis, interpretation, and estimation of the data.

Your research must be strategically driven through two probing problems:

-Would you invest your financial capital in selected firm as a shareholder?

-Would you invest your human and intellectual capital in firm as an employee?

Steps in preparation of the financial analysis report:

1). Choose a publicly held company.

2) Choose a benchmark firm to compare your company against. The benchmark firm is typically the largest competitor.

3) Obtain the firm’s balance sheet, statement of cash flows, and income statement for the past 5 years. Download or read the firm’s annual report.

4) Go to: http://www.sec.gov/edgar/searchedgar/webusers.html

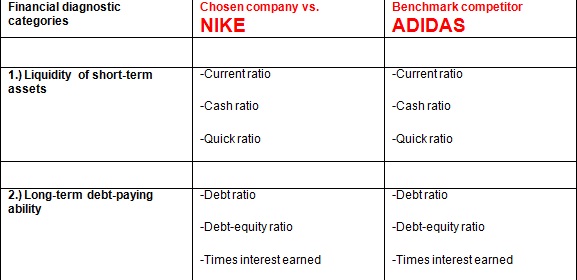

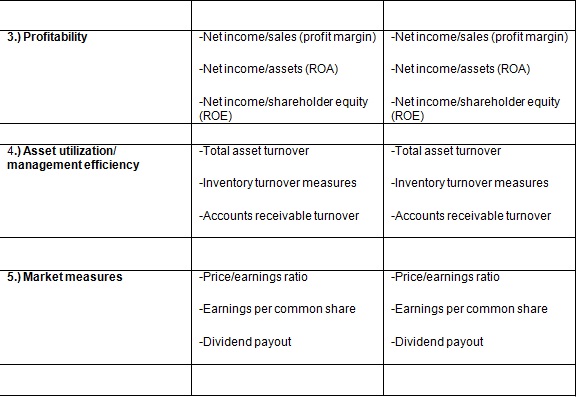

5) The give table is the type of Excel or Word table which must be employed to gather and report your ratio and financial performance data. Note the 5 financial diagnostic categories which must be employed in your analysis.

Use 2-3 ratios per diagnostic category. Place your ratio computations in table for your selected companies—primary company and benchmark competitor. By using 5 diagnostic categories, and 3 ratios to assess each category, results in 15 ratio measures per company that will be compared side by side.

6) To validate your research, 5 years of data are required.

7). Financial analysis report template shown below.

8). Financial Analysis Summary. Based on your research and ratio analyses and computations, comment on the subsequent problems:

- How well has management added value?

- Is the company's financial performance enhancing?

- Would you invest your financial capital in selected firm as a shareholder? Why or why not?

- Would you invest your human and intellectual capital in firm as an employee? Why or why not?