problem 1: prepare a comparative note on the Accounting Standards and Accounting conventions and Accounting Concepts.

problem 2: Describe cash flow and funds flow analysis with appropriate ex from an existing corporate entity for at least three years that is, 2008, 2009 and 2010.

problem 3: Prepare format of Profit and Loss account and Balance Sheet as per latest guidelines of companies act.

problem 4: A proforma cost sheet of a company provides the given particulars:

Elements of Cost

Material 40%

Direct Labor 20%

Overheads 20%

The given further particulars are available:

a) It is proposed to maintain a level of activity of 2,00,000 units.

b) Selling price is Rs.12 per unit.

c) Raw materials are expected to remain in stores for an average period of one month.

d) Materials will be in process, on averages half a month.

e) Finished goods are needed to be in stock for an average period of one month.

f) Credit permitted to debtors is two months.

g) Credit permitted by suppliers is one month.

You might suppose that sales and production follow a consistent pattern.

You are required to make a statement of working capital requirements, a forecast Profit and loss account and Balance Sheet of the company.

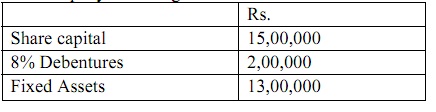

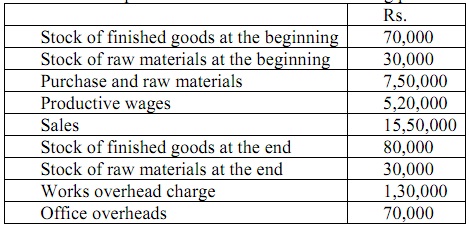

problem 5: From the given particulars make a cost sheet and show what the amount of the quotation would be if 20% on selling price.

The company is intending to send a quotation for a big plant. The estimated material cost is Rs.50,000, wages Rs.30,000.