problem 1: Assume that the pension you are managing is holding Rs.15 million of six-year bonds, and if their interest rate increases by 1%, the bonds will fall in price by 7 points. Assume that as well that when its interest rate rises by 1%, the five-year Treasury bond contract drops by 6 points and when The T-bond futures contract interest rate increases by 1%, on average the interest rate on the six-year Treasury bonds increases by 1.2%.

Required:

What must you do in the futures market to hedge the interest rate risk on Rs.15 million of six year bonds?

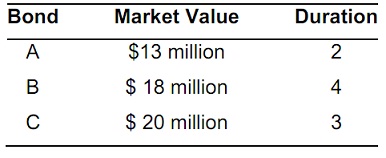

problem 2: Your Company owns the given bonds:

If general interest rates increase from 8% to 8.5%, what is the estimated change in the value of the portfolio?

problem 3:

a) Distinguish between option contracts and futures contracts.

b) Why are option contracts usually more desirable for hedging than futures contracts when a financial institution is conducting a macro hedge?

problem 4: Laser Ace is selling at $22.00 per share. The most recent annual dividend paid was $0.80. By using the Gordon Growth model, if the market needs a return of 11%, determine the expected dividend growth rate for Laser Ace?