ANSWER ALL 4 problemS

problem 1

The primary financial objective of corporation is usually taken to be the maximization of shareholder wealth.

Discuss:-

i. Ways in which the shareholder of a company can encourage its managers to act in a way which is consistent with the objective of maximization of shareholder wealth.

ii. What other objectives may be important to a public limited company and whether such objectives are consistent with the primary objective of shareholder wealth maximization.

iii. What is the purpose or benefit of published financial statements for companies?

iv. Why the management of working capital is important for a business?

problem 2

Do ratio analysis by comparing the four companies financial statements, analysis and interpretation on the four-basic group : (Refer to table A) Liquidity ratio Asset Management ratio Leverage ratio Profitability ratio Market value ratio

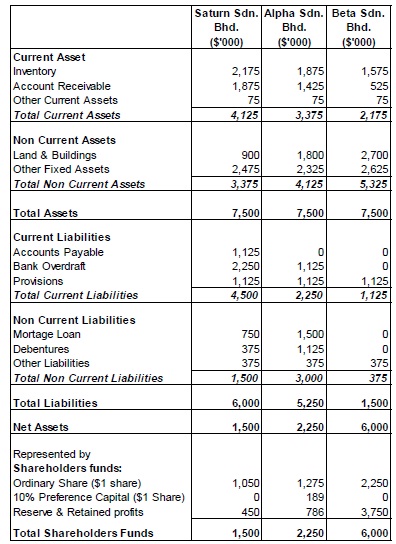

table A:The list below are the condensed statement of Financial position of three public listed company in Malaysia. They are Saturn Sdn. Bhd., Alpha Sdn Bhd., and Beta Sdn. Bhd.

Additional information: Saturn Sdn. Bhd. ($'000) Alpha Sdn. Bhd. ($'000) Beta Sdn. Bhd. ($'000)

Market Price $4.20 $4.65 $7.35

TotalOrdinaryDividend $249,000 $286,875 $551,250

Opening Inventory $1,955,000 $1,923,000 $1,551,000

Opening Account Receivable $1,525,000 $1,325,000 $495,000

Shareholders Fund $1,500,000 $2,250,000 $6,000,000

No of Employees $200 $220 $250

Motage Loan (Duration) 1.5 years 4 years -

Debenture (Duration) 2 years 5 years -

Note : Assume all firms operate in same industry and the opening balance of shareholders funds is the same as closing balance (No Change)

Saturn Sdn. Bhd. ($'000) Alpha Sdn. Bhd. ($'000) Beta Sdn. Bhd. ($'000)

Total Sales 9,000 9,000 9,000

Less:Costofgoodssold 6,000 6,000 7,350

GrossProfit 3,000 3,000 1,650

Less:OperatingExpensesDepreciation 300 280 310

Interest 100 210 0

Lease Payments 70 70 70

Others 1,855 1,652 145

Total Expenses 2,325 2,212 525

Net Profit Before Tax 675 788 1,125

Taxation 225 263 375

Net Profit After Tax 450 525 750

Required:

a) find out all the ratios for the company.b) Base on the ratios you have find outd, comment on the financial structure and relative profitibality of each company. What short term actions would you advice any of the companies to take.c) Each company is considering a major investment of $1,700,000. Advice on how each of the company should finance the expansion. Also discuss the effect of your decision on the profitability of the company.

problem 3

The 5Z Company is selling pens to the local market. It is planning to maximize sales and profit by analyzing few conditions using the break-even analysis formula. Below is the data provided for you to make the decision:

Fixed cost per annum $70,000

Unit selling Price $20

Unit Variable cost $10

Existing Sales 8,000 units

Relevant range of output 4,000 to 12,000 units

a) What is the output level at which 5Z Company Break even (that is makes neither a profit nor a loss)?

b) How many units must be sold to obtain $30,000 profit?

c) What is the profit that will result from a 10% reduction in variable costs and a $10,000 decrease in fixed costs, assuming that current sales can be maintained?

d) What is the selling price which would have to be charged to show a profit of $40,000 on sales of 8,000 units?

e) What additional sales volume is required to meet $8,000 extra fixed charge from a proposed plant expansion?

problem 4

Xcell engineering is planning to construct a futsal stadium which has 5 courts to be rented out at any point of time. Its initial cost of investment is RM$280,000. It is expected to generate sales of RM$20,000 per court for year one and a 10% increase for every year from year 2 to year 5. The operating cost for year one for per court is RM$7,000 and it also expected to increase by 10% each year from year 2 to 5. At year 5 it can cease operation by selling the business to Mr.Free for RM$280,000. The cost of capital is 10%. Will you recommend this project to be financed by your company? Use NPV method to show your calculations.