Problem 1

A firm just paid a dividend of $2 and the growth rates are forecasted to be 3% in the first period and then 2% for every period afterwards. The stock has a required rate of return of 12%.

- Find the dividends payments for periods 1, 2, and 3.

- Find the price of the stock at time 1.

- Find the price of the stock at time 0 (today).

- If the stock is trading for $12.75 would you buy it or want to sell it?

Problem 2

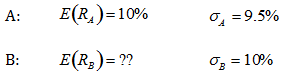

Suppose that you have the following information about two assets.

In the context of the relationship between risk and return, what must be true about the expected return for B? Should the expected return for B be higher, lower, or the same as the expected return for A?

Problem 3

A firm has 5m shares of common stock outstanding at a market value of $20/share. The last dividend paid was $2 and the growth rate is expected to be 3% indefinitely. The firm has 20,000 bonds outstanding at a market price of $1025. The coupon rate is 5% paid semi-annually and there is 1 year to maturity. If the tax rate is 34%, what is the firm's weighted average cost of capital? Under what assumption can the WACC be used as the required rate of return for an investment project?

Problem 4

What is the objective of the firm? What is your objective in studying business? Are those objectives the same? Explain briefly.