problem 1: What do you mean by Investment Decisions? How is it distinct from Financing Decisions?

problem 2: Critically examine different theories of Capital Structure?

problem 3: What are the six component planning sequences of Project Planning?

problem 4: What is the Mathematical expression for the Critical Ratio? What does it tell a Manager?

problem 5: Compute Weighted average and Cost of Capital from the given:

a) Equity Share Capital Rs. 3,50,000/- with cost of equity @10% Market value is Rs.4,50,000

b) 8% Preference Shares of Rs.4,00,000/ and its market value is Rs.4,50,000/-

c) 6% Debt of Rs.6,00,000 and its market value is Rs.5,60,000/-.

d) Retained earnings Rs.1,50,000, that has no change in the market value. It cost is equivalent to that of cost of equity.

problem 6: Why must we be concerned with risk in Capital Budgeting? Is the standard derivation a sufficient measure of risk? Can you think of a better measure?

problem 7: What is the post sanction monitoring? How is monitoring exercised by Financial Institutions (FIs) in India?

problem 8: Describe the implications of making Dividends Tax Free?

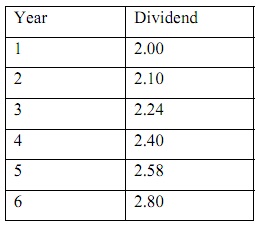

problem 9: From the given data, supposing a 16 % required return and Rs3.00 per share dividend from 7th year, find out the value of share after finding out growth rate from the given data.

problem 10: What do you mean by the term Corporate Restructuring? What motivates an enterprise to engage in Restructuring Exercise?