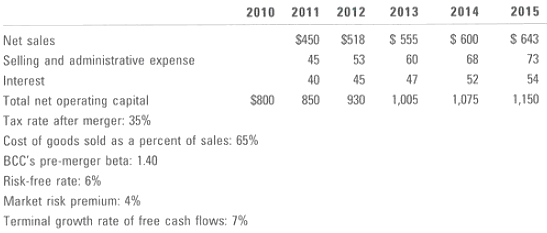

VolWorld Communications Inc., a large telecommunications company, is evaluating the possible acquisition of Bulldog Cable Company (BCC), a regional cable company. VolWor1d's analysts project the following post-merger data for BCC (in thousands of dollars, with a year end of December 31) :

If the acquisition is made, it will occur on January 1, 2011. All cash flows shown in the income statements are assumed to occur at the end of the year. BCC currently has a capital structure of 40% debt, which Costs 10%, but over the next 4 years VolWorld would increase that to 50%, and the target capital structure would he reached by the start of 2015. BCC, if independent, would pay taxes at 20%, hut its income would be taxed at 35% ii it were consolidated. BCC's current market-determined beta is 1.4. The cost of goods sold is expected to be 65% of sales.

a. What is the unlevered cost of equity for BCC?

b. What are the free cash flows and interest tax shields for the first 5 years?

c. What is BCC's horizon value of interest tax shields and unlevered horizon value?

d. What is the value of BCC's equity to VolWorld's shareholders if BCC has $300,000 in debt outstanding now?