problem 1: Berick Ltd: A Capital Expenditure Decision

Berick Ltd is a relatively small engineering company which manages to compete effectively with larger companies through adapting to changing market requirements and specialising in the innovative products with the limited markets. The products are sold to a huge range of companies; however most of its sales are to companies in oil industry. On this basis it has maintained a high rate of return on the capital employed in relation to the engineering sector as an entire. The newest product to be developed, a high pressure valve, has completed its testing stage and the company now has to decide on whether or not to invest in a production facility and a marketing programme.

The work already undertaken on product has cost £1.3 million and it is anticipated which some further development work will cost a further £0.2 million. It is estimated that an investment of £9.00 million will be essential in plant and machinery. This expenditure can be written off (capital allowances) for tax purposes on a straight-line basis over the product’s expected six year life. It is anticipated that the resale value of equipment will be about £2.00 million at the end of the six years. The outlay would have been larger; however the company already owns some finishing equipment that will be needed. This was previously employed in the manufacture of another product that is no longer being produced. It is fully depreciated for tax purposes and could be sold today for £180,000. If employed for the next six years it will have no re-sale value.

The production facility would be located in one of company’s factories with spare capacity accessible. It will occupy 15 per cent of the factory’s space. The company has no alternative uses accessible for this space for the foreseeable future and has further spare capacity accessible in other factories. The product will be charged £50,000 per annum for this space by the company’s management accounting system, though only 20 per cent of this figure will stem from incremental costs resulting from heating and lighting. The fixed costs directly attributable to production are expected to be £ 90,000 per annum. Each product sold by the company is also allocated a general overhead charge equal to 10 per cent of the revenues it generates. This allocation is made by the company’s accountant to cover head office expenses.

The selling price is expected to be set at £38.00 per unit and it is anticipated that sales in first year will be about 150,000 units, rising to 200,000 in year two, and staying at this level for the subsequent four years. The introduction of the product would need a marketing campaign that will cost £150,000. As a result of the rapid technological development in area a six year product life is all that can be expected.

The direct manufacturing costs are expected to be £12.00 per unit. The company will require holding stocks of product at start of each year equal to 25 per cent of the sales expected in the year to come. The raise in debtors as a result of introducing the product will be just about offset by the increase in creditors. The company needs a rate of return of 14 per cent on investments of this nature, and the tax rate is 40 percent.

1) Verify the investment’s net present value and the internal rate of return. All key assumptions should be specified and describeed.

2) Undertake a sensitivity analysis for the assumed price and volume of expected sales and interpret your results carefully.

3) Give a brief general discussion of the potential risks associated with this investment

problem 2)

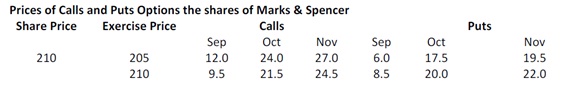

Prices of Calls and Puts Options the shares of Marks & Spencer

1) Elucidate carefully why the November calls are trading at higher prices than the September calls.

2) Draw a diagram illustrating a straddle, using calls and puts expiring in November and an exercise price of 210. Elucidate the circumstances in which an investor may consider it worthwhile to invest in a straddle.

3) Develop a covered call using the data provided and comment on nature of the payoffs produced and the potential uses of the strategy