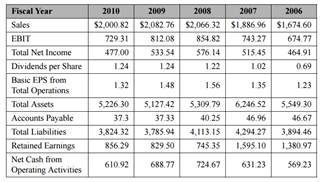

Using the data for Paychex, Inc. (Nasdaq: PAYX), presented below:

a. Calculate the ratio of each years' data to the previous year for each of the above items for Paychex, Inc. For example, for the year 2010, the ratio for sales is $2,000.82/$2,082.76 = 0.9607.

b. From your calculations in part a, calculate each year's rate of growth. Using the example in part a, the ratio is 0.9607, so the percentage growth in sales for 2010 is 0.9607 - 1 or -3.93%.

c. Calculate the average growth rate (using the AVERAGE function) of each of the above items using the results you calculated in part b. These averages are arithmetic averages.

d. Use the GEOMEAN function to estimate the compound annual average growth rate (CAGR) for each of the above items using the results that you calculated in part a. Be sure to subtract 1 from the result of the GEOMEAN function to arrive at a percent change. These averages are geometric averages.

e. Compare the results from part c (arithmetic averages using the AVERAGE function) to those for part d (geometric averages using the GEOMEAN function) for each item. Is it true that the arithmetic average growth rate is always greater than or equal to the geometric average (CAGR)?

f. Contrast the results for the geometric averages to those for the arithmetic average for the variables listed below. What do you observe about the differences in the two growth estimates for Sales and Accounts Payable? What do you observe about the differences in the two estimates for Total Assets and Retained Earnings? Hint: Look at the results from part b (the individual yearly growth rates) for each variable to draw some conclusions about the variation between the arithmetic and geometric averages.

1. Sales

2. EBIT

3. Total Assets

4. Accounts Payable

5. Retained Earnings