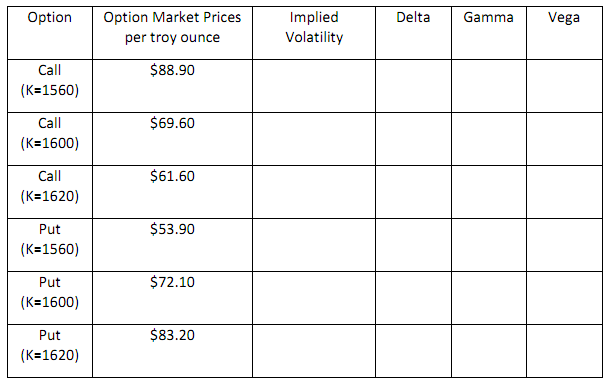

The six month gold futures price is currently 1598. The riskOfree interest rate is 4.50 per annum with continuous compounding. The market prices for fivemonth options on gold futures trade on CME are displayed on Table. The contract size of the underlying gold futures contract is 100 troy ounces.

(a) Use Excel's goalseek tool function to complete the table with the estimate implied volatilities (correct to 4 decimal places).

(b) By using the implied volatilities of part (a), calculate the greek letters and complete the table with the values of the greek letters for the options listed.

You hold the following portfolio

Long 40 fivemonth gold futures contracts

Short 40 call options on gold futures with strike of 1620 and maturity of five months

Long 40 put options on gold futures with strike of 1600 and maturity of five months

(c) Construct the table and the diagram showing the profit-loss (as a function of the terminal futures price) of each component position and of the combined position of your portfolio.

(d) This portfolio resembles a well known trading strategy. Which strategy is it? Explain why?

(e) What are your expectations on the future market conditions, in terms of direction and volatility, when this strategy is used?

(f) Calculate the current value, the delta, the gamma and the vega of your portfolio. Interpret the value of the greek letters of your portfolio.

(g) After a day, the futures price has decreased to 1578. Estimate the value of your portfolio and the delta of the portfolio.

(h) You are willing to make your portfolio delta and vega neutral by trading gold futures and the call option on gold futures with strike price of 1620. What positions on these options and gold futures are required? What is the cost of this hedge?

(i) By using the put call parity and the call and put options with strike of 1620 identify any arbitrage opportunities available. Provide a detailed description of the strategy that will allow you to lock in arbitrage profit and calculate the arbitrage profit