MK Robe-Stones Limited Business Plan

MK Robe-Stones (MK-R-S) is a large manufacturing firm which was set up as a Limited company 6 years ago, in 2009, by a family organisation. The firm was originally started as a business to sell the main family business by-product which is a type of oil. MK Robe-Stones main product is therefore a by-product of this process, which is primarily involved in the Chemicals business.

At the conception the firm (MK-R-S) the initial capital for the company came from the Director of the Parent Company (Gordon Robe-Stones), his children, Jack, Lucinda and Josh Robe-Stones’ and a few other individuals whom knew of the prospects of the company. The total capital which they managed to gather via this method was £5,000,000. The company by the end of its first year trading had retained profits which accumulated to £507,000. Thus by the end of the companies first year, the Profit and Loss Statement and the Balance Sheet had the following composition. (Short-form only):

31st January 2009

Profit and Loss Account of MK Robe-Stones Ltd.

Sales Revenue £ 8,902,300

Cost of Sales £ 6,870,120

Gross Profit £ 2,032,180

Administration Expenses £ 879,000

Distribution Expenses £ 230,000

Operating Profit £ 1,383,180

(Net) Interest £ 50,500

Profit Before Tax £ 1,332,680

Taxation £ 466,438

Profit Attributable to Shareholders £ 866,242

Dividends Paid to Shareholders £ 359,242

Retained Profit C/F £ 507,000

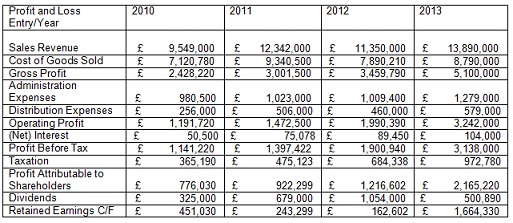

The subsequent years following up to the present day, the company has the Profit and Loss statements of:

The industry benchmarks for the companies which are in similar industries are as follows for the key financial ratios. The information which is presented below is the 5 year average and associated standard deviations in terms of % (or terms of reference):

Ratio Average Standard Deviation

Gross Profit Margin 28% 8%

Operating Profit Margin 13% 7%

Return on Capital Employed 26% 3%

Current Ratio 10.04 : 1 3.0

Asset Turnover £1.96 : 1 £0.89

Gearing Ratio 15.6% 5%

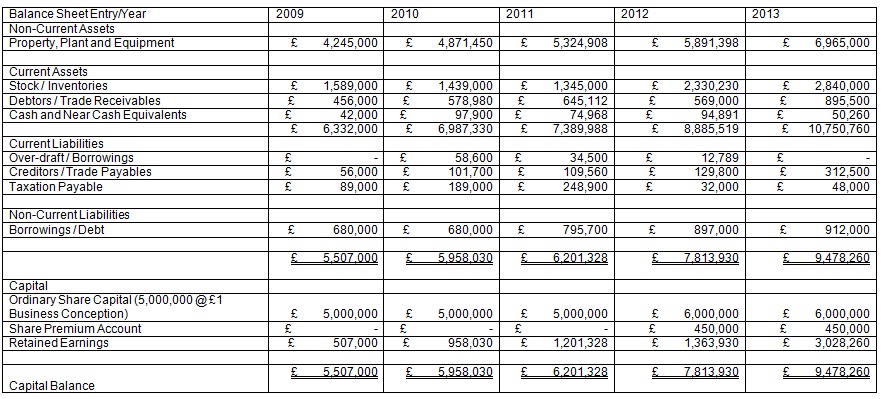

The respective years’ Balance Sheets are as follows:

The company has been providing good returns to the shareholders of the organisation over the last few years. However, the senior managers are having concerns since they have been aware that the firm is becoming a considerable investment in terms of their personal time. They are thinking of investing some extra money in terms of equity capital that will secure a reduction in the direct labour hours which are needed to run the firm effectively. The effect of this would be a projected saving of 7% of the Costs of Sales, for the given a given increase in the Sales Revenue Projections. This would have the conditions of a 9% increase in the Administration and Distribution Expenses.

The company has also been contacted by a local banking organisation, which has informed the Management that they are running low on cash, and have offered them a loan of £500,000, to help them with the current cash flow situation. The company would be looking at paying a Rate of Interest on the Loan of 6.5% p.a. and making no long-term capital repayments for at least 10 years.

Required:

A. As a Management Consultant, with some financial expertise you have been asked to prepare a Report to the Management of the firm which covers the Company performance over the last 5 years, in detail, including 2013’s results. This is expected to cover the key performance ratios of Profitability, Liquidity and Efficiency and Financial Structure Ratios. Where ever possible you should draw upon the Financial Information provided by the industry averages to make a comparison.

B. The Management have asked you to consider the possibility that the firm may become insolvent and assess whether the loan would help with this aspect specifically. The Manager would like you find out the Ratios involved in Financial Bankruptcy Projections (I.e. Altman’s Z-Score and any others). You should critically appraise this model of Bankruptcy Projection stating any assumptions that you make in the report.

C. The report should also detail to the Management some of the theoretical drawbacks of the type of analysis, and generally the weaknesses of the Ratio Analysis.

D. The management would also like you to put together a projection of the company making a (in line with the average sales increase?) and an investment of £649,000 in the fixed assets of the company, which could be paid for by taking out the loan of £500,000.

You are required to state any other supplementary assumptions which you make.