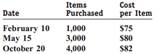

The purchase schedule for Laundryman's Corporation is as follows:

The inventory balance as of the beginning of the year was $35,000 (500 units @ $70 each). During the year ended December 31, the company sold 6,000 units for $150 per unit. Expenses other than cost of goods sold totaled $125,000. The effective income tax rate is 30 percent.

REQUIRED:

a. Prepare three income statements, one under each assumption-FIFO, LIFO, average.

b. How many tax dollars would be saved by using LIFO instead of FIFO?

c. Assume the market value of an item of inventory dropped to $78 as of the end of the year. Apply the lower-of-cost-or-market rule, and provide the appropriate journal entry (if necessary) under the FIFO, LIFO, and average assumptions.

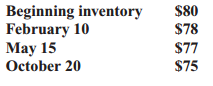

d. Repeat (a) above, assuming the costs per item were:

Which of the three assumptions now gives rise to the highest net income and ending inventory?