Question

Derby Ltd operates a chain of department stores in Melbourne which uses a courier company for deliveries. The cost of using the courier for the year ended January -December 2014 is estimated to be £500,000 and this will then rise by 10% a year. The Board is currently considering an alternative strategy of acquiring and managing its own transport fleet from January 2014

The initial cost of the transport fleet in January 2014 would be £1,500,000 and it is estimated that the fleet would be sold in December 2018 for £300,000.

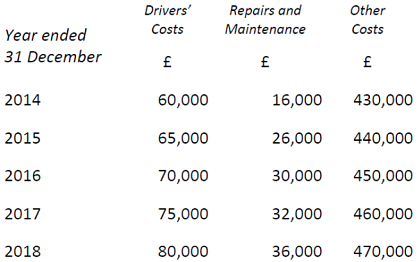

The Management Accountant of Derby Ltd has produced the following cost estimates relating to the proposal over the next five years:

The figure for "Other Costs" includes depreciation on the fleet on the straight-line basis. The head office administration costs of Hamilton ltd are budgeted to be £300,000 per annum, and in line with company policy, 10% of Head Office costs would be allocated to the cost of running the fleet and are therefore included in "other costs" above. On questioning, the finance director indicates that he believes there is sufficient spare capacity in the Head Office to carry out the additional work.

The project manager for the new fleet also believes that the vehicles will not be fully utilised on company business and she estimates that the spare capacity could be used for sub-contract work which would generate £100,000 per annum.

To raise funds for the project the company proposes to raise a loan at 12% interest rate per annum. As Director of Strategy, you are also aware that funds are limited as the proposed loan of £1,500,000 is the maximum the directors are prepared or able to raise at this time. You are further aware that there is an alternative proposal that the Board is considering to use the funds to establish a new outlet in London. This project has already been evaluated as having a Payback period of 4 years and a Net Present Value of £280,000

Required:

a. Calculate the following for the transport fleet project:

i. Payback period

ii. Net Present Value