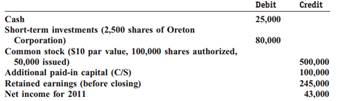

The following selected financial information was extracted from the December 31, 2011, financial records of Cotter Company:

The company's board of directors is currently contemplating declaring a dividend. The company's common stock is presently selling for $40 per share.

REQUIRED:

a. Given the present financial position of Cotter Company, how large a cash dividend can the board of directors declare?

b. How large a stock dividend can the board legally declare?

c. Assume that the dividends are declared and issued on the same day. Prepare the journal entry to record the maximum dividend in each case above.

d. If the company sold its short-term investments, how large a cash dividend could it declare and pay? The current selling price of Oreton Corporation is $50 per share.