problem 1 – Financial Planning

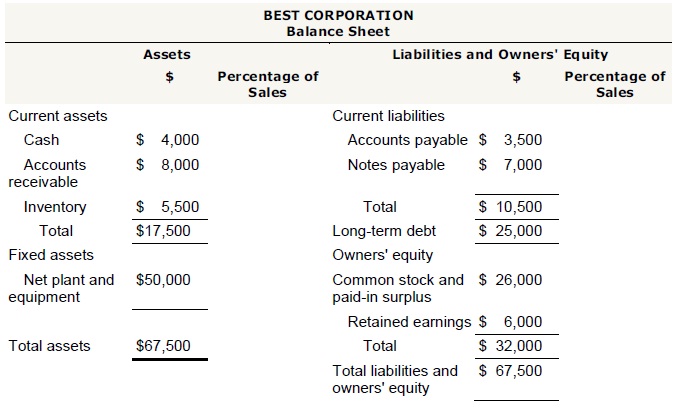

Consider the following income statement and balance sheet for the BEST Corporation:

BEST CORPORATION

Income Statement

Sales $50,000

Costs $14,000

Taxable income $36,000

Taxes (34%) 12,240

Net income $23,760

Dividends $5,000

Addition to retained earnings $18,760

Assume costs vary with sales and the dividend payout ratio is constant. What is the projected addition to retained earnings?

Assume that accounts payable vary with sales, whereas notes payable do not. Prepare a pro forma income statement balance sheet showing EFN, assuming a 15 percent increase in sales, no new external debt or equity financing.

problem 2 – Bond Refunding

Rogers Communication is considering whether to take advantage of historically low Canadian interest rates and lower its cost of debt by refunding its old bonds. Rogers has a $50million bond issue outstanding with a 12 percent annual coupon. These 15 year bonds were sold 5 years ago, and can be called in at a 10% call premium. According to investment bankers, the firm can sell $60million, 10 year bonds with an annual coupon rate of 8 percent, and floatation costs of $5million. Rogers’ marginal tax rate is 40%. The new bonds will be sold one month before the old issue is called, and funds can be invested in treasury bills yielding 8%. The additional $10million from the new bond issue could be invested in a 10 year project with an expected NPV of $2.5million. Should Rogers proceed with the refunding? The answer should show all four working steps.

problem 3 - ODA

3a. To qualify as official development assistance (ODA), development loans must have a grant element of at least 25 percent, find outd using a stated annual interest rate of 10 percent. After the Solomon Islands earthquakes, new US Secretary of State John Kerry toured the quake-stricken country and promised the following loan: $100 million, to be amortized over 6 years by 12 semi-annual payments, after a grace period of 4 years during which only interest would be paid semi-annually. The US would charge interest at a stated annual rate of 6 percent. Determine whether or not this loan would qualify as ODA. What is the maximum interest rate the US could charge for this loan to qualify as

ODA?

3b. One of the projects the US loan would fund is to build earthquake-resistant buildings. The project will begin in March 2013, last for two years and is expected to have the following expenditures: start-up costs of $200,000 paid at the beginning of the first month; rental of equipment to be paid at the beginning of the month that will be $100,000 each month for the first year, but $50,000 each month for the second year; material costs to be paid at the end of each month that will be $30,000; personnel costs of $100,000 to be paid at the end of each month; and end-of-project clean-up costs of $100,000 that will be paid at the end of the last month (February 2015). Suppose that with the fiscal cliff looming in March 2013, Secretary Kerry is only willing to allocate $3,000,000 of the US loan at the start of the project due to this concern. These funds are put into an account that pays interest at a stated annual rate of 12 percent, compounded monthly. find out how much this project needs at the beginning of the second year that would be necessary to cover its expected expenditures.

problem 4 – Risk and Return

4a. Professor Wiseman provides you with the following table which gives some characteristics of two risky assets - stocks and bonds. Also shown are weights in the market portfolio P, which is assumed to be mean-variance efficient, i.e., it provides the highest expected return for its level of variance.

Asset Weigh in Market Portfolio P Expected Return Standard Deviation Correlation With Stocks Correlation With Bonds

Stocks 0.50 ? 0.20 1.00 0.20

Bonds 0.50 ? 0.10 0.20 1.00

If the expected return on the market portfolio P, E(rP) is equal to 0.09 or 9 percent, what are the expected returns on stocks and bonds? Assume the risk-free rate, rf is equal to 0.04 or 4 percent and show all working steps clearly.

4b. The following is a scenario for three stocks constructed by Professor Wiseman’s students:

Scenario Return

Stock Price Recession Average Boom

A $10 -15% 20% 30%

B $15 25% 10% -10%

C $50 12% 15% 12%

Construct an arbitrage portfolio using these stocks.

problem 5 – Capital Budgeting

Suppose that Oxford Inc. is interested in the two new products, AME and CGK. Because of its capital budget constraint, it can only launch one new product line. Eric just graduated from the School of Administrative Studies at York University and works for Oxford as an analyst. On Thursday, his manager asked him to evaluate the two new product lines and needs the recommendation by next Monday. Necessary equipment for the production line AME will cost $10 million, including installation costs. Product line AME will also require an initial investment of $3million in net working capital. Product line AME will generate pre-tax revenues that are $5.6 million for the first year. Then the pre-tax revenue will grow at an annual rate of 2 percent for the next 14 years. A new technology will replace the product AME after that. The pre-tax operating costs will be $2.2 million/year for the first 10 years, then $3.3 million/year for the next 5 years. The salvage value of AME will be $0.39 million at the end of year 15. New equipment and installation costs for product line CGK will be $ 7 million and the initial working capital requirement will also be $3million. Production line CGK will generate pre-tax revenues that are $4.8 million for the first year. Then the pre-tax revenue will then increase at an annual rate of 3 percent for the next 14 years. A new model is in R&D process and will replace the CGK after that. The pre-tax operating costs will be $2.5 million/year for the first year and then grow at an annual rate of 2 percent for the next 14 years. The salvage value of CGK will be $0.27 million at the end of year 15.

The initial equipment purchase falls into a CCA Asset Class 8 at a rate of 20 percent, regardless of which alternative is chosen. Oxford’s corporate tax rate is 40 percent and its rate of required return on such investments is 12 percent. Assume the initial working capital investment will be made at the time of the purchase the equipment for either product line. For simplicity, all cash flows for a given year occur at the end of the year. If you were Eric, which new product line would you recommend on the basis of NPV and IRR?