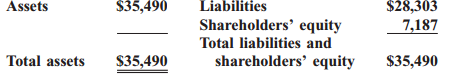

The condensed 2008 balance sheet of Honeywell International follows (dollars in millions):

Seven hundred thirty-five million shares of common stock and no preferred stock were outstanding.

The following requirements are independent:

a. Compute the book value per common share.

b. Compute the book value per common share if the company issues 50 million shares of common stock at $32 per share.

c. Compute the book value per common share if the company issues 50 million shares of common stock at $20 per share.

d. Compute the book value per outstanding share of common stock if the company purchases 50 million shares of treasury stock at $32 per share.

e. Compute the book value per outstanding share of common stock if the company purchases 50 million shares of treasury stock at $20 per share.

f. What effect does issuing stock have on the book value of the outstanding shares? Upon what does this effect depend?

g. What effect does purchasing treasury stock have on the book value of the outstanding shares? Upon what does this effect depend?