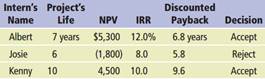

The CFO of Horatio's Hotels gave three college interns three different independent projects to evaluate. Following are the results of their analyses:

The CFO agrees with the final accept/reject decision that each intern made. But she spotted an error in the numbers reported by one of the interns.

(a) Which intern's report has the error?

(b) Does the information given here provide an indication of the firm's required rate of return? Explain your answers.