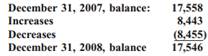

The 2008 IFRS-based balance sheet published by Volkswagen AG, a well-known German automaker, listed an account called "provisions" (divided into current and non-current categories) with a total balance (in million euros) of 17,546 (2008) and 17,558 (2007). The footnotes to the financial statements included the following statement and account information.

"In accordance with International Accounting Standard (IAS) 37, provisions are recognized when an obligation exists to a third party as a result of a past event; where a future outflow of resources is probable; and when a reliable estimate can be made. Provisions . . . are recognized at their (expected) settlement value discounted to the balance sheet date. Discounting is based on market rates."

REQUIRED:

a. Discuss differences between how provisions are accounted for under IFRS and how contingencies are accounted for under U.S. GAAP.

b. Explain how the increases listed above (8,443) affected the basic accounting equation, and list what kinds of items might be reflected in the 8,443 increase amount.

c. Explain how the decreases listed above (8,455) affected the basic accounting equation, and list what kinds of items might be reflected in the 8,455 decrease amount.