Simulation

The State Opera Theatre gains significant revenue from ticket sales at each opera performed during the season. The sale of souvenir programs for all performances of each opera also adds to profitability.

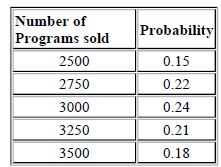

Each program costs $1.60 to produce and sells for $4.00. Any programs unsold at the end of any opera are donated to a recycling centre and do not produce any revenue. Records of the programs sold for each opera show the following:

(a) Your manager has asked you to determine the profitability of the souvenir program production.

You decide to use Excel to simulate the sale of programs at 10 operas in a season together with the profit or loss on programs for each opera. You decide to investigate the strategy where the number of programs to be printed should be the number sold at the previous opera. You will have to generate a dummy sale for a "previous" opera to begin with. Include a calculation of the total profit/loss for the season and the average profit/loss per opera.

Show the data and the model in two printouts: (1) the results, and (2) the formulas. Both printouts must show row and column numbers and be copied from Excel into Word. (You can do this using the Print Screen command in Excel and then pasting (or CTRL+V) in the Word document.

(b) If the theatre management decided to print 3000 programs for each opera calculate the profit or loss in each of the 10 operas and the average profits for the whole season. You can do this using your Simulation model in (a) and adjusting where necessary to incorporate any additional or differentcalculations. Which of the two production strategies (the one in (a) or the one in (b) provides the higher profit for the season and on average?

(c) Write a report to your manager advising

(1) the advantages and disadvantages of simulation models; and

(2) why a manager might be forced to use simulation instead of an analytical model in dealing with:

(i) an inventory ordering policy, and

(ii) bank teller windows