Security Analysis and Portfolio Management Homework

The purpose of this assignment is to gain some familiarity with option payoff diagrams, multi-period binomial option pricing, and Black-Scholes option pricing.

Question 1 - Payoff Diagrams

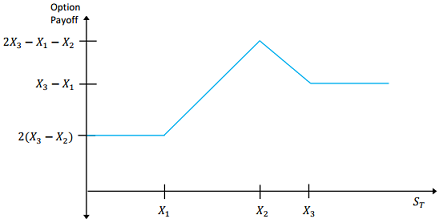

a. Consider the following payoff diagram at time T. Describe a portfolio of European puts expiring at T and a risk-free asset that will generate the payoff structure. Verify that the portfolio works with a payoff table. You may only use put options and a risk-free asset, but you can long or short puts of any strike and long or short any amount of the risk-free asset.

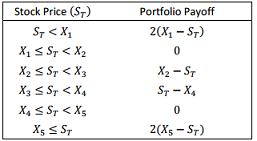

b. Consider a portfolio of European put and call options which pays the amounts listed in the following table at expiration. Construct a payoff diagram for this portfolio.

Question 2 - Black-Scholes Option Pricing

a. Suppose stock in AMC Entertainment Holdings (a cinema company) is currently trading at $25 per share. Assuming the risk-free interest rate is 1% per year (compounded continuously) and the volatility of the stock is 30%, what is the value of an at-the-money call option expiring in 3 months?

b. Using the information from part (a), how much should the call price change if the stock price increases by $1?

c. Suppose the stock from part (a) was trading at $22 per share. What would be the implied volatility (assume the strike is still $25)?

Question 3 - Binomial Option Pricing

On April 25, 2016, Valeant Pharmaceuticals hired a new CEO, Joe Papa. The executive compensation contract between Valeant and Joe Papa is highly incentive-based, calling for Joe Papa to receive a mixture of cash, restricted share units (RSUs), and performance-based restricted stock units (PSUs). RSUs are shares of stock already received by Joe Papa that he cannot sell until a specified vesting date. Joe Papa received 373,367 RSUs that vest on April 25, 2020. PSUs are shares of stock that will be granted if certain conditions related to the stock price are met. The base grant is 933,416 PSUs, with Joe Papa receiving a certain percentage of the base amount on April 25, 2020, depending on the stock price at that time, as summarized in the following table.

|

Type

|

Quantity

|

Vesting Condition

|

|

PSU

|

25%

|

$60

|

|

PSU

|

50%

|

$90

|

|

PSU

|

75%

|

$120

|

|

PSU

|

100%

|

$150

|

|

PSU

|

125%

|

$180

|

|

PSU

|

150%

|

$210

|

|

PSU

|

175%

|

$240

|

|

PSU

|

200%

|

$270

|

a. Draw the payoff diagram for the PSU portion of this compensation contract. You can think of a PSU as a knock-in call with a strike equal to zero.

b. The closing price of Valeant Pharmaceuticals stock on April 25, 2016 was $35.16. Each quarter between the grant date (April 25, 2016) and the vesting date (April 25, 2020), the stock price may either increase by 15% or decrease by (1-1/1.15)%. Assume that the risk-free rate from the grant date until the vesting date is constant at 2% per year compounded continuously. According to the binomial option pricing model, what is the value of Joe Papa's PSU compensation?

c. The ex ante value of the PSU compensation is nowhere close to the $500 million stated in the title of the Forbes article. In a majority of outcomes, the ex post value of the PSU compensation is actually zero. Why do you think corporations compensate their executives in this fashion? Think about risk aversion. Why do you think the media tendsto sensationalize executive compensation?

Attachment:- Assignment.rar