Roseville Medical manufactures a single product called the Gripper. Under the direction of physiotherapists patients with hand injuries use the Gripper to restore, to the extent possible, normal hand functions.

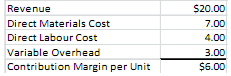

The Gripper has the following per unit revenue and costs:

The sales manager at Roseville Medical believes that, at this price, Roseville Medical can sell a maximum of Grippers of 350,000 per year. Roseville Medical has fixed manufacturing costs of $1,000,000 per year and fixed selling, administrative, and general expenses of $500,000 per year.

The variable overhead associated with the Gripper reflects the variable overhead associated with the Gripper's consumption of machine time which is 0.05 hours per unit. Roseville Medical incurs $60.00 of variable overhead costs for each hour the machines are used. There are 20,000 hours of machine time available each year.

Required: In all the following questions ignore taxes and show all calculations.

1. How many Grippers must Roseville Medical sell in order to breakeven?

2. How many Grippers must Roseville Medical sell in order to earn a target profit of $500,000?

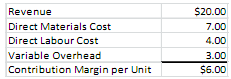

3. The Roseville Medical sales manager has come up with an idea for a new product called the Gripper Plus which could be produced on the existing machines. The sales manager believes that Roseville Medical could sell a maximum of 100,000 units of the Gripper Plus. The Gripper

Plus has the following per unit revenues and costs:

Given this information how many units of the Gripper Plus, if any, should Roseville Medical produce?

4. How, if at all, would your answer to part 3 change if the revenue per unit of the Gripper Plus was $38.00 per unit?

5. Consider the setting in Part 4. Suppose now that a contractor has offered to do contract manufacturing for Roseville Medical. The contractor would supply as many units of the Gripper Plus as Roseville Medical requires. What is the maximum (ceiling price) that Roseville Medical should be willing to pay for each Gripper Plus unit the contractor supplies and how many would Roseville Medical buy at this price?

6. The production manager believes that with an adaptation of the existing machines, costing $500,000, the time required to make each product could be reduced by 10%. If the adaptation is expected to last a maximum of 2 years is this change financially attractive? Use the setting in part 4 above to answer this question.

7. Return now to the basic data in part 1 of this case. That is, ignore all the changes mentioned in parts 2-6. Roseville Medical has the opportunity to replace the existing machine with a new machine costing $400,000 (net of the salvage value of the old machine). Each Gripper would require 1/15 hour per unit on the new machine and the variable overhead costs associated with each hour of the new machine would be $40.00. If the new machine would last 3 years, is this replacement financially attractive?