Relevant Costs and Transfer Pricing

AB Company specialises in electronic products. Division A makes integrated circuits and sells 90% of its output to outside companies. This division is operating well below capacity.

Division B has developed a new product codenamed XK120 that could use the circuit made by Division A. The manager of Division A has quoted a transfer price of $80 per circuit, which is below the current market price, and which would provide a $40 contribution margin.

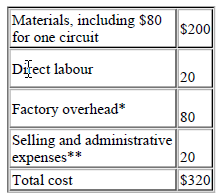

The accountant of Division B has provided the following estimates of costs for XK120:

* $40 fixed, $40 variable, **$10 fixed, *10 variable

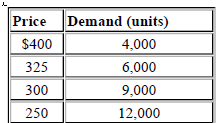

The marketing manager of Division B has submitted the following estimates of their demand schedule for XK120:

Division A has enough capacity to meet the 12 000 maximum volume that Division B could obtain.

Divisional managers are evaluated on ROI, and total investment would be the same for any of thevolumes that Division B may sell.

(a) As the manager of Division B, given the transfer price of $80, what price would you charge for XK120 and what volume would you sell?

(b) Given the price calculated in (a), what total contribution would be earned by:

(i) Division A?

(ii) Division B?

(d) From the point of view of the managing director of AB Company, what price should Division B charge for XK120, and what volume should be sold in order to maximise return on investment for the company as a whole?

(e) If the volume calculated in (c) were to be met, what is the minimum transfer price that could be accepted by Division A so that its total contribution would be no less than that calculated in (b)(i)?

(f) If the volume calculated in (c) were to be met, what is the maximum transfer price that could be paid by Division B so that its total contribution would be no less than that calculated in (b)(ii)? (4marks)

(g) If the managing director is determined that Division B should sell that volume which produces the optimum result for the company as a whole, what justification could be given to the divisional manager of Division A in requiring him to accept a transfer price equal to that calculated in (e)?