Question: Using the data as outlined in problem, prepare a pro forma income statement for the first 4 months of the calendar year for Student Services Inc., given the following additional information: The plant from which the company operates is 5 years old and originally cost $600,000. The equipment was purchased at the same time at a cost of $ 1 20,000. The plant has a remaining life of 20 years, and the equipment's remaining life is 5 years. Assume that capital cost allowances are taken on a straight-line basis over the life of the assets, and that the assets have no residual value. Inventory is not shipped to the retailers until the month after it is acquired. All goods that are acquired are shipped, so there is no excess inventory. Ignore interest on the line of credit.

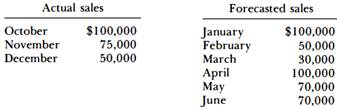

Problem: Student Services Incorporated acts as a wholesaler to the various student retail shops that operate on campuses throughout Canada. They supply clothing, records, and confectionery items. They have a $75,000 line of credit with a local bank, and they draw on their account in amounts of $5,000 at a time. As at December 31, the firm had a cash balance of $7,000, which is the minimum balance that the firm wants to maintain. The following additional information is available.

Accounts receivable: Terms are net 30 days. From past experience 60 percent of the accounts are collected within a month, 30 percent within 60 days, and 10 percent within 90 days. Bad debts are negligible. Accounts payable: Accounts are paid promptly at the time of purchase. Cost of goods sold: 90 percent of sales. The goods are ordered, received, and paid for in the month prior to sale. Administrative expense: $3 ,000 per month, plus a bonus of 4 percent of gross sales realized during the last quarter of the calendar year. This bonus is paid in February of each year. Dividends: $5,000 in dividends will be paid in March. Taxes: The tax rate is 40 percent. $2,000 in taxes for the past year must be paid by January 15, and no other taxes are payable in the period January to April. Salaries: Wages and salaries amount to 15 percent of the monthly dollar sales or $ 1 0,000, whichever is greater. No capital expenditures are planned. Prepare a cash budget for the period January to April inclusive. In your budget, show the amount and timing of any bank borrowings.