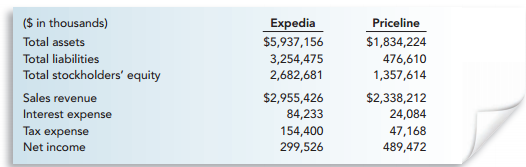

Question: Two leading online travel companies are Expedia and Priceline.Selected financial data for these two close competitors are as follows:

Required: 1. Calculate the debt to equity ratio for Expedia and Priceline. Which company has the higher ratio? Compare your calculations with those for Coca-Cola and PepsiCo reported in the chapter. Which industry maintains a higher debt to equity ratio?

2. Calculate the times interest earned ratio for Expedia and Priceline. Which company is better able to meet interest payments as they become due? Compare your calculations with those for Coca-Cola and PepsiCo reported in the chapter. Which industry has a better times interest earned ratio?