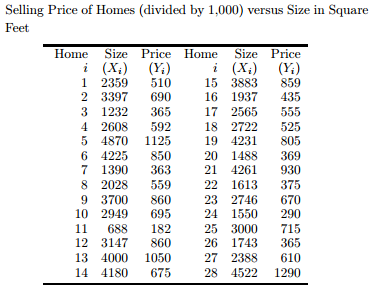

Question: The selling price and size of a home for a suburb of Los Angeles in the year 1997 are shown in Table 6.6. At the time, even a small empty lot would cost at least $200,000. Verify that based on the least squares regression line for these data, if we estimate the cost of an empty lot by setting the square feet of a house to X = 0, we get 38, 192. What does this suggest about estimating Y using an X value outside the range of observed X values?