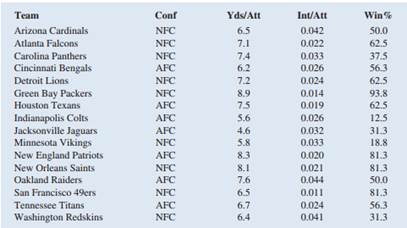

Question: The National Football League (NFL) records a variety of performance data for individuals and teams. To investigate the importance of passing on the percentage of games won by a team, the following data show the conference (Conf), average number of passing yards per attempt (Yds/Att), the number of interceptions thrown per attempt (Int/Att), and the percentage of games won (Win%) for a random sample of 16 NFL teams for the 2011 season (NFL Web site, February 12, 2012).

a. Develop the estimated regression equation that could be used to predict the percentage of games won, given the average number of passing yards per attempt. What proportion of variation in the sample values of proportion of games won does this model explain?

b. Develop the estimated regression equation that could be used to predict the percentage of games won, given the number of interceptions thrown per attempt. What proportion of variation in the sample values of proportion of games won does this model explain?

c. Develop the estimated regression equation that could be used to predict the percentage of games won, given the average number of passing yards per attempt and the number of interceptions thrown per attempt. What proportion of variation in the sample values of proportion of games won does this model explain?

d. The average number of passing yards per attempt for the Kansas City Chiefs during the 2011 season was 6.2, and the team's number of interceptions thrown per attempt was 0.036. Use the estimated regression equation developed in part c to predict the percentage of games won by the Kansas City Chiefs during the 2011 season.

Compare your prediction to the actual percentage of games won by the Kansas City Chiefs.

e. Did the estimated regression equation that uses only the average number of passing yards per attempt as the independent variable to predict the percentage of games won provide a good fit?