Question: The iPod

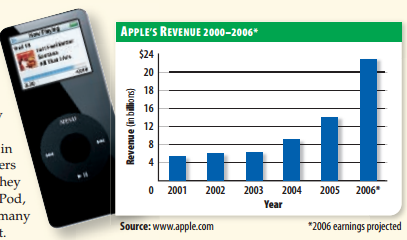

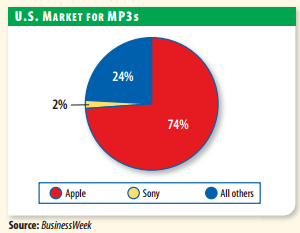

The Idea: Handheld music devices date back to the 1970s, when Sony introduced the Walkman. So why has the iPod dominated the MP3 market in the early 2000s? When the iPod hit store shelves in November 2001, other MP3 players were already on the market. Yet they were larger than the 6.5-ounce iPod, and they could not hold nearly as many songs. The iPod was an instant hit.

Innovation: Technology set off the iPod in other ways. The mechanical scroll wheel allowed easy scrolling and navigation. FireWire allowed much faster transfer of music from the computer to the iPod. In 2003 Apple CEO Steve Jobs announced that the iTunes software, formerly used to store and play digital music on a Mac, would become a gateway to the online iTunes Store. The owners of iPods now were able to download songs for just 99¢ each. While Apple makes only about .10¢ per sale, it generates many more iPod sales. On top of that, music from the iTunes Music Store can be played only on Apple devices because of Apple's digital rights management technology. This tempts more

people to purchase iPods.

Staying Ahead of the Pack: Apple continues to innovate. In January 2004, Apple introduced the iPod mini. Its "click wheel" removed the need for buttons. Newer models can hold ever larger volumes of data, while tiny flashmemory chips keep the player size small. Today's iPods can store up to 10,000 songs, hold hundreds of photos, and play entire movies. Adapters connect iPods with car or home stereo systems. By constantly updating, Apple has been able to keep its huge market share ever since the iPod was introduced.

Analyzing the Impact Question

1. Summarizing What features allowed Apple's iPod to dominate the market?

2. Drawing Conclusions How does Apple continue to stay ahead of the competition?