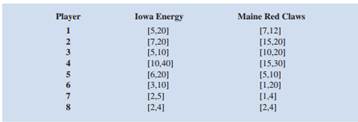

Question: The Iowa Energy are scheduled to play against the Maine Red Claws in an upcoming game in the National Basketball Association Developmental League (NBA-DL). Because a player in the NBA-DL is still developing his skills, the number of points he scores in a game can vary. Assume that each player's point production can be represented as an integer uniform variable with the ranges provided in the following table:

a. Develop a spreadsheet model that simulates the points scored by each team.

b. What are the average and standard deviation of points scored by the Iowa Energy? What is the shape of the distribution of points scored by the Iowa Energy?

c. What is the average and standard deviation of points scored by the Maine Red Claws? What is the shape of the distribution of points scored by the Maine Red Claws?

d. Let Point Differential 5 Iowa Energy points - Maine Red Claw points. What is the average point differential between the Iowa Energy and Maine Red Claws? What is the standard deviation in the point differential? What is the shape of the point differential distribution?

e. What is the probability that the Iowa Energy scores more points than the Maine Red Claws?

f. The coach of the Iowa Energy feels that they are the underdog and is considering a riskier game strategy. The effect of this strategy is that the range of each Energy player's point production increases symmetrically so that the new range is [0, original upper bound 1 original lower bound]. For example, Energy player 1's range with the risky strategy is [0,25]. How does the new strategy affect the average and standard deviation of the Energy point total? How does that affect the probability of the Iowa Energy scoring more points that the Maine Red Claws?