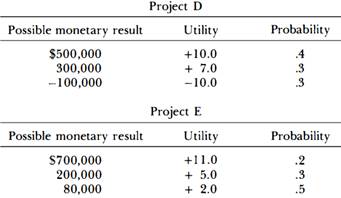

Question: The financial manager of P.B. Company is considering two projects, D and E, with the following information:

(a) Assume that the certainty-equivalent coefficient for project D is .5. Calculate the expected monetary value, the expected utility, and the certainty equivalent (dollar amount) of D.

(b) Perform the same calculations for project E, assuming that the certainty-equivalent coefficient for E is .65.

(c) Which project should the financial manager accept? Why?