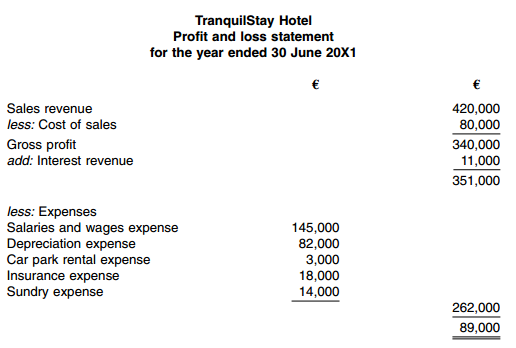

Question: The accounting manager at Antwerp's TranquilStay Hotel has prepared the following profit and loss statement that pertains to the most recent accounting year

The accounting manager is uncertain how to handle year-end adjusting entries and has sought your advice. Following a review of the business, you determine the following:

1. A A2,500 advance payment received in connection with a conference to be held in late July has been included in the sales revenue figure.

2 Employees have not been paid A4,000 in wages and salaries earned in the last 4 days of June.

3 Depreciation of A10,000 on a new car purchased this year has not been recorded.

4 The hotel rents a small adjoining property which it uses for patrons' car parking whenever the hotel's underground car park is full. The last rental fee paid was A900. This payment was made on 1 May and covered a three-month period. The account manager recorded this as prepaid rent and no entry has been made to adjust this account at the year-end.

5 The hotel holds an investment that earns A1,000 interest per month. June's interest, which will be received in July has not been recorded in the accounts.

6 Annual property insurance of A24,000 is paid semi-annually in advance. The last A12,000 payment, which was made on 1 April 20X1 was debited to prepaid insurance. No adjusting entry to the prepaid insurance account has been made.