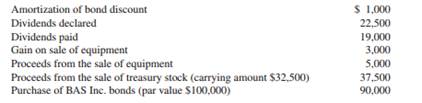

Question: Superfine Company collected the following data in preparing its cash flow statement for the year ended December 31, 2014:

Required: Determine the following amounts that should be reported in Superfine's 2014 statement of cash flows.

1. What amount should Superfine report as net cash used in investing activities?

2. What amount should Superfine report as net cash provided by financing activities?